WWE’s Rights Fees Are a Masterclass in Reading Streamers’ Psychology — Not Just Their Budgets

If you think the ESPN/WWE PLE news is “just another big rights deal,” you’re missing the point.

The real story isn’t the number.

It’s that Nick Khan, Paul Levesque, and Ari Emanuel have once again timed the exact psychological moment legacy media is in — and sold into that need. Not once. Not twice. Three times.

It is growth marketing at the billion-dollar level.

Let’s break down why it keeps working.

The Streaming Business Is Brutally Simple

Every streamer has two jobs:

Acquire new subscribers

Keep the ones they already have

Everything- what gets bought, canceled, renewed, or promoted, flows from that. We’re not in cable economics anymore. There’s no distributor handing over twelve cents. It’s $9.99… or $12.99… or in ESPN’s case, $29.99 directly from the customer.

And subscriber lifetime value (LTV) is the north star. The longer someone stays, the more valuable they are.

So what do you buy?

Something sticky. Something evergreen. Something global. Something with a fan base that doesn’t unsubscribe and churn out.

Which brings us to WWE.

WWE Doesn’t “Follow the Money.” WWE Sells Into Need.

The pattern is unmistakable, and repeatable, if you know what you’re looking for.

2021: Peacock Needed Immediate Scale

NBCU had just launched Peacock. Big ambitions, slow subscriber growth.

They needed a turnkey, high-retention audience. And they needed it yesterday.

WWE Network delivered exactly that: a global fan base, an always-on content library, and a tentpole event schedule.

The rumored ~$1B acquisition price was math.

@wrestlenomics estimated 2.7M–2.9M users watched WrestleMania 40. If just 2M people stayed on the platform at $9.99/mo, that’s $600 in LTV over 5 years:

2M x $600 = $1.2B+ in topline. Before ad revenue.

Peacock bought retention through content.

2024: Netflix Needed Its Next Growth Engine

Shared password crackdown complete. Global expansion momentum restored. The next frontier? Live, global, evergreen.

Enter WWE. A 10-year, $5B bet to lock in a fan base that translates across borders. The drama and athleticism of pro wrestling translates just the same in Saudi Arabia and the US as it does Argentina and Pakistan.

This wasn’t about prestige. It was about engagement hours. Sticky hours.

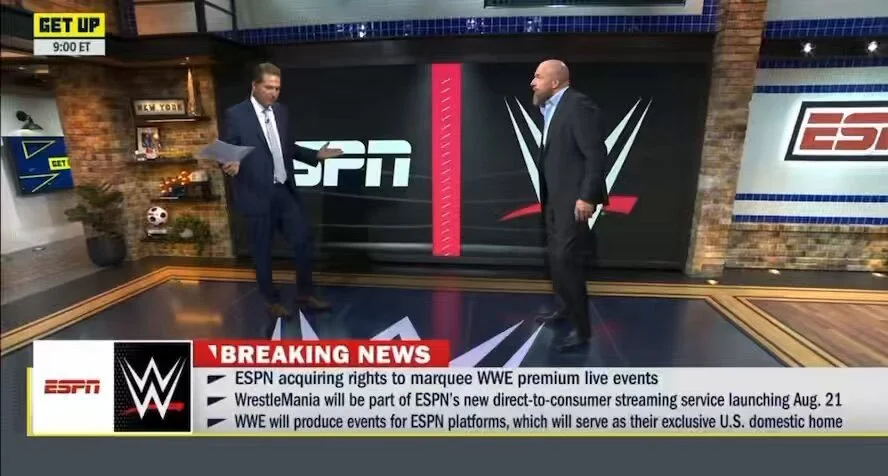

2025: ESPN Needs a Killer Launch at $29.99

ESPN’s new DTC bundle drops August 21 and the price point is aggressive: $29.99.

For that to land, it needs a high-frequency engine that:

Drives sign-ups

Reduces churn

Broadens demo

WWE PLEs do all three. So the huge $1.6B deal makes sense. It’s subscriber insurance.

The Playbook: Identify the “Growth Moment” and Strike

Across all three deals, the pattern is identical:

Streamer in a growth or launch phase

WWE offers a committed, high-retention audience

The check looks big but is relatively defensible in LTV

That’s how you ride the streaming wave instead of drowning in it.

And now there’s a new wrinkle.

TKO and WWE’s Acquisition of AAA (Lucha Libre Wrestling) Unlocks a Second Cycle of Value

Here’s the nuance:

With this plan, you can usually only sell your core product to each platform once.

But with the AAA acquisition (one of Mexico’s top pro wrestling federations- CMLL is their competitior), WWE now has:

A new demo

A new cultural product

A new advertiser set

A second library

A bilingual growth engine

U.S. Hispanic audiences are the fastest-growing demo in the country. Lucha libre is a distinct, and monetizable, identity.

Peacock might not want more traditional WWE… But bilingual WWE hitting a different audience with different advertisers?

That’s a fresh value story.

WWE can effectively re-run the entire media-rights playbook with a new asset.

WWE Is Selling Into What Streamers Feel, Not Just What They Spend

That’s the whole thing. Timing is everything.

Peacock needed growth now.

Netflix needed global subscriber stability.

ESPN needs a $29.99 launch engine.

And Paramount+? They need a post-Skydance subscriber story.

Which brings us to the “fourth time” example that TKO just completed — WWE’s sister brand, UFC.

UFC x Paramount+ — $7.7B over 7 years

Paramount+ fits the TKO playbook perfectly.

Deal closes

David Ellison, the new CEO, wants a splash

The platform needs momentum

UFC delivers an identity, a demo, and weekly appointment viewing

It’s the same psychological read. Just a different sport.

The Bottom Line

WWE isn’t chasing bags. They’re selling certainty.

In a market terrified of churn, they’re the most reliable retention engine on the board — and they price accordingly.

Three cycles. Four if you count UFC.

And now, with AAA, my money’s that the loop can start again.

Nobody is doing it better.