Lessons to Learn From Netflix’s Sports Strategy

Netflix finally opened the books on how its sports content is performing. Two years of global viewership data, surfaced in Julia Alexander’s sharp analysis for Puck — gives the industry something it’s been missing: clarity.

There’s real informantion here for any league, promotion, or rights holder trying to scale in the streaming era. Here are the lessons that actually matter.

Lesson 1: Live Events Still Dominate the Attention Economy

Netflix’s live experiments weren’t half-steps; they were tests to see what actually moves global audiences.

Jake Paul vs. Mike Tyson → 49.1M views

Two NFL Christmas Day Games → 28.7M combined

The takeaway is blunt: Live spectacle is still the fastest way to create a cultural moment.

Netflix doesn’t seem to be chasing full-season schedules. They’re chasing high-impact events that justify marketing and drive massive spikes in usage. That’s a clue for anyone trying to understand the modern value of “eventized” sports.

Lesson 2: Documentaries Are Strategic Wins

Sports documentaries won’t come close to the performance of live events, and Netflix doesn’t expect them to. Their value is different:

Documentaries let Netflix attach its brand to IP it doesn’t own (Olympics, F1, NFL).

They keep bringing in viewers long after the actual event is over.

This is long-tail strategy, not ratings strategy. We all know the story of Drive to Survive helping create the boom period Formula One currently finds itself in. In this instance, Netflix wouldn’t own any of the actual races, but fans looking to continue learning more (or being introduced to) F1 do it through the documentary, which in some cases might arguably be the more compelling watch (the drama!). If you’re a league or promotion: a strong documentary isn’t just PR, it’s pipeline. It expands the surface area for discovery and makes your sport (or your talent) sticky.

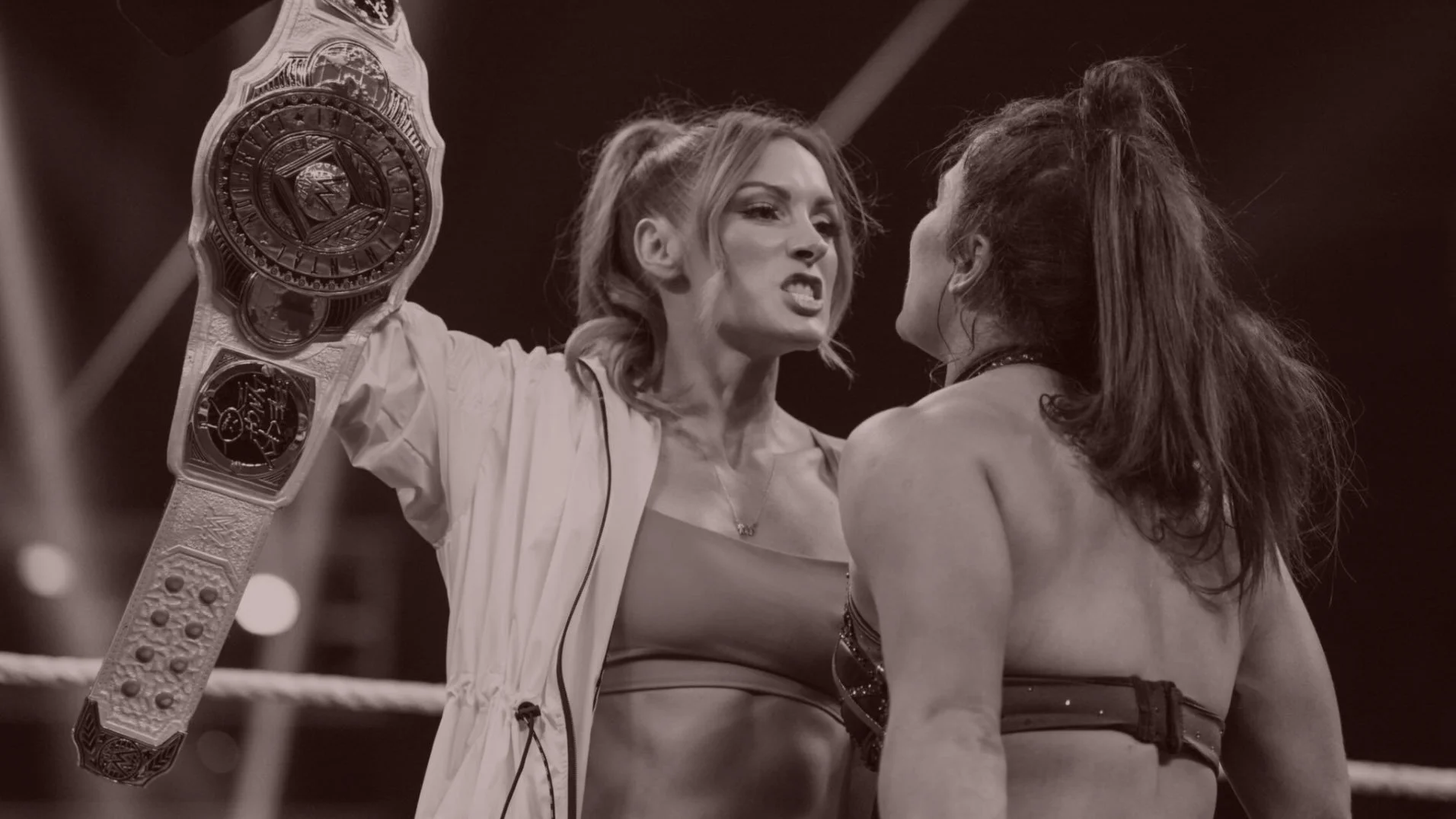

Lesson 3: Pro Wrestling Might Be the Most Underpriced Category in Streaming

This is the number that will surprise traditional TV executives but not wrestling people:

Raw is averaging ~3.4M views per week on Netflix — roughly double its audience on USA Network.

That’s before you factor in:

High-performing docs like Mr. McMahon

Ad inventory selling out immediately

Global distribution with minimal localization requirements

Characters built for clips, memes, and social spillover

The truth is simple: Pro wrestling is sports content that already behaves like franchise entertainment. It’s built for the Netflix model. Yes, Netflix is global, and USA Network is not, but double the reach with one partner instead of five to get there also simplifies the management effort for WWE.

This should be a wake-up call for competitors like AEW, TNA, and NWA. NWA’s FAST move is a step. OVW’s new ownership should be thinking aggressively given how well their docuseries “Wrestlers” traveled.

But there’s a broader, market-wide opportunity here. WWE just proved the demand is real.

Lesson 4: Netflix Isn’t Trying to Be ESPN, They’re Building an Entertainment IP Machine

Most analysts still misread the strategy.

Netflix isn’t pursuing:

Scores

Standings

Highlight shows

Full schedules

They’re pursuing:

Characters

Story arcs

Tentpole moments

Global, rewatchable IP

Ad inventory they can sell immediately

In other words, they’re treating sports the way they treat their biggest entertainment franchises.

If you’re a league or promotion, the implication is obvious: If your sport can behave like IP, not just competition, your ceiling is higher.

This Is A Great Blueprint for Any Property Trying to Scale

Netflix’s approach isn’t niche:

Make live events feel like cultural moments.

Use docs as perpetual discovery engines.

Build characters, not just competitors.

Think globally from day one.

Design content that travels without explanation.

Anyone who wants to grow- wrestling promotions, fight leagues, challenger sports, even college properties — should be watching this closely.

Netflix is rewriting the sports property handbook.

Link: https://puck.news/netflixs-sports-scorecard-whats-working-whats-not/